-

Solutions

- Skill Library

-

Platform

Effective Simulators

- Coding Simulators

- AI-LogicBox

Video Interviews

- Automated Video Interview

- Live Coding Interview

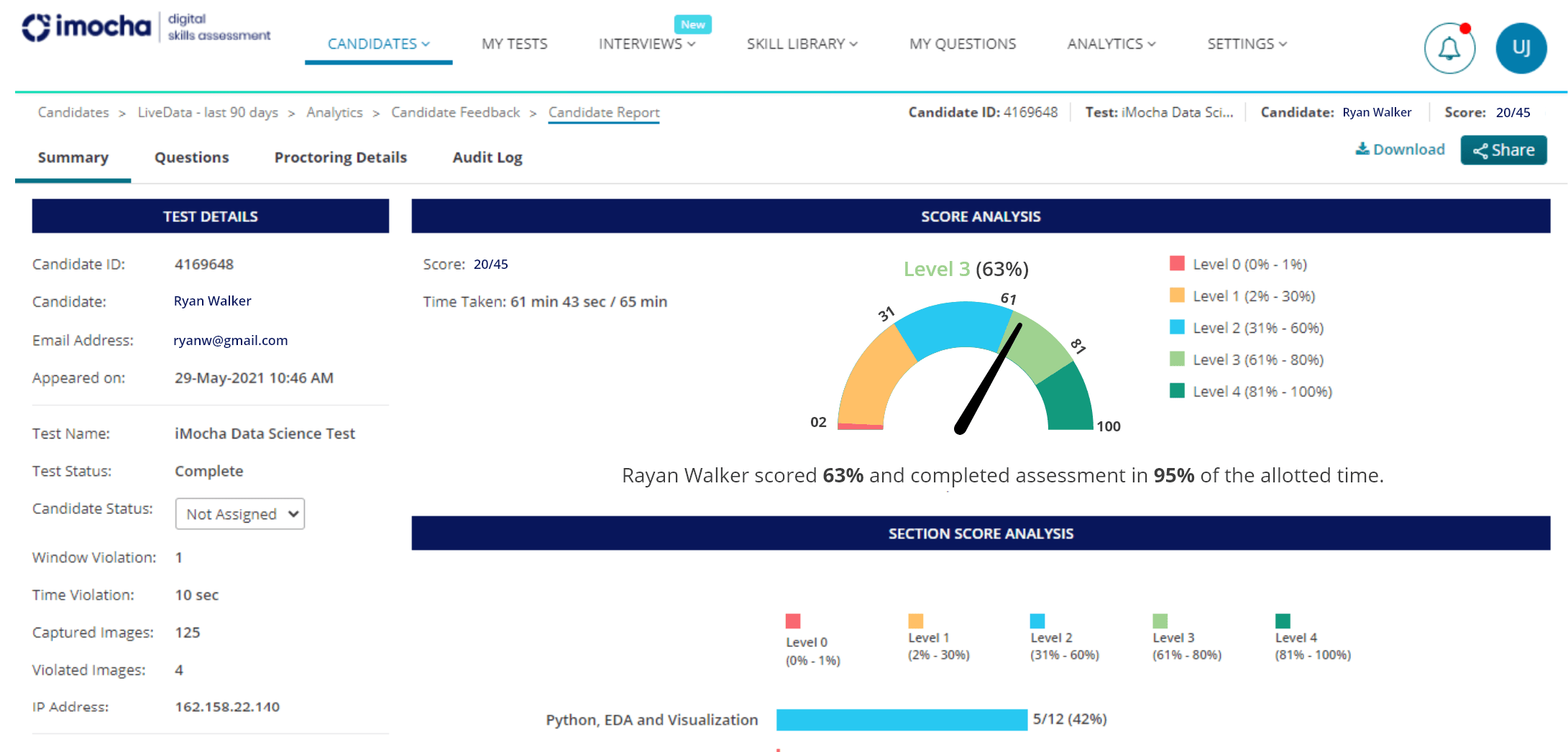

Proctoring

- Smart Video Proctoring

- AI-enabled Proctoring

Enterprise Ready Platform

- Recruitment Platform

- Enterprise Readiness

- Upskilling Assessment Portal

- Pricing

-

Resources

- Solutions

- Skill Library

-

platform

Effective Simulators

- Coding Simulators

- AI-LogicBox

Video Interviews

- Automated Video Interview

- Live Coding Interview

Proctoring

- Smart Video Proctoring

- AI-enabled Proctoring

Enterprise Ready Platform

- Recruitment Platform

- Enterprise Readiness

- Upskilling Assessment Portal

- Pricing

-

Resources

- Customer Case Studies*

-

Guides and Whitepapers

- Learning & Development Guide

- Campus Recruitment Guide

- Cognitive Abilities Guide

- Remote Hiring Guide

- Pre-employment testing- The Ultimate Guide

- A Study on Correlation between Cognitive Ability and Job Performance

- View All Guides

- Blog

- Podcasts

- Newsroom

- Events

- Customer Interviews

- Knowledge Base

- Integrations

- API Developer Documentation

- Contact Us